Weak Sales Send O’Reilly’s Shares Plunging

On Wednesday, July 5th, O’Reilly Automotive’s shares plummeted by 20 percent after the auto parts retailer headquartered in Springfield, Missouri, reported weaker than expected same-store-sales-growth. This was due to the fact that same-store sales of the aftermarket car-parts chain missed its forecast for the second quarter.

In addition to O’Reilly, peers AutoZone Inc. and Advance Auto Parts also saw their shares plunging on Wednesday. Many see this as a consequence of weak early-year demand and Amazon.com Inc’s plans to launch an offensive in the industry.

After Amazon’s entry into the grocery world and all the noise it made recently, companies of all kind are starting to wonder if they’re the next target for the e-commerce juggernaut. For investors, this is a real problem, and with Amazon setting its sights on automotive parts, things are only going to get harder for O’Reilly and kind.

O’Reilly reported comparable-store sales growth of 1.7% for the 2nd quarter. This was lower than the FactSet’s estimated growth of 3.9 percent and the company’s previous estimates of 3 to 5% growth. The 20% drop in shares has made the company’s stock the biggest decliner in the S&P 500 index, and it was on track to become its worst daily performance ever.

Headquartered in Springfield, Missouri, the auto parts retailer O’Reilly, operates more than 4,500 stores in 47 U.S states. According to Greg Hanslee, the CEO of the company, two consecutive mild winters and ‘overall weak consumer demand’ were the reasons behind O’Reilly’s shares plummeting. As quoted by Bloomberg, Hanslee had the following to say:

“After exiting the first quarter and entering April on an improved sales trend, we faced a more challenging sales environment than we expected for the remainder of the quarter. While we are disappointed with our sales results in the first half of the year, we remain confident in the long-term health of our industry.”

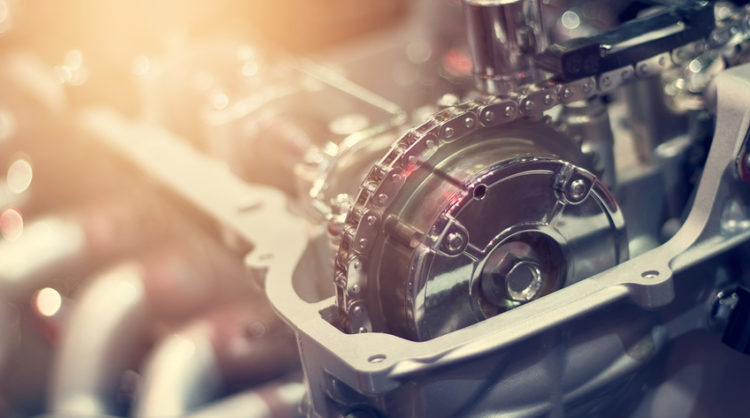

O’Reilly can blame ‘overall weak consumer demand’ all it wants but the fact of the matter is that customers will keep buying from you as long as you provide them ‘what they want’. When it comes to automotive parts, customers today want their chosen auto parts dealer to provide them with anything and everything they want including replacement engines, used auto motors, replacement auto engines, used transmissions for sale, Japanese replacement engines, low mileage Japanese engines, used Japanese motors, used truck motors, etc.

Following seven straight years of record-setting volumes, car sales in the US slowed down in the first half of 2017. Though sales have softened, continued employment growth suggests that auto-parts consumer purchases may remain healthy.

Sources:

https://www.fool.com/investing/2017/07/05/oreilly-automotive-shares-plunge-20-after-comparab.aspx

Related posts

Common Mistakes Drivers Make When Buying A New Engine

Your car’s engine is one of the most important parts of your vehicle. Unfortunately, many drivers have common misconceptions about what to look for in a new or used engine. This often leads to mistakes that can be costly later on. But how can you be sure you’re not making a mistake when you’re investing […]

Top 3 Ranked Japanese Engines

In 2016, the top three goods that were imported were: vehicles, machinery, electrical machinery. The reasons why America bought $50 billion worth of automobiles from Japan in 2016 is because of the vehicles’ reliability and high-quality engines. If you are looking to buy the best Japanese engines, low mileage Japanese engines, used Japanese transmissions, or […]

Advances in Engine Technology

Cars aren’t going anywhere in the foreseeable future. Toyota alone is estimated to produce over 11 million cars in 2023. Having a high quality engine is one of the most important parts to overall car health and performance. Whether you are looking for a used Japanese engine, or new imported engines from Japan, it is […]